Unlocking Malaysia's Financial Heartbeat: A Deep Dive into Tax

Key Takeaways

- Foundational Role of Tax: Taxation is the core engine for Malaysia's financial health, funding public services and influencing economic stability.

- Individual and Corporate Contributions: Malaysia employs a progressive individual income tax system, complemented by corporate taxes, ensuring contributions align with earning capacity.

- International Tax Framework: A network of international tax treaties prevents double taxation, fostering smoother global trade and investment.

- Indirect Taxes and Economic Impact: Beyond income, indirect taxes on goods and services significantly boost government revenue, impacting nearly every transaction.

- Technological Advancement: Digital platforms like MyTax streamline tax administration, enhancing efficiency and user compliance.

- Future-Oriented Policies: Malaysia is actively exploring new tax frontiers, including a carbon tax by 2026, reflecting a commitment to sustainability and evolving economic strategies.

Have you ever wondered how countries make money to build roads, run schools, and keep things safe? The answer often comes down to one big word: Tax. It's a topic that might sound a bit serious, but understanding tax in Malaysia is super important for everyone, whether you live there, work there, or even just visit. It's like the main engine that keeps the country's finances running smoothly, directly affecting how people plan their money and follow the rules. This week, we're going on an exciting journey to explore the ins and outs of Malaysia's tax system, looking at everything from what you pay as an individual to how big businesses contribute, and even what new changes are coming up!

The world of Malaysian tax can seem a bit like a puzzle at first, with many pieces to fit together. But don't worry, we're here to help make sense of it all. We'll explore how taxes work for everyday people and for big companies, and even how Malaysia deals with money rules with other countries. Getting a good grasp of this system is key for anyone trying to manage their money well and make sure they're doing everything by the book. It’s not just about paying money to the government; it's about being a part of the bigger picture that helps Malaysia grow and develop. So, let's pull back the curtain and uncover the fascinating world of Malaysian taxation!

The Basics: What is Tax and Why Does it Matter in Malaysia?

At its heart, tax is money that people and businesses pay to the government. This money is then used for public services that benefit everyone. Think of it like a community fund where everyone puts in a little so that big projects can happen. In Malaysia, understanding this system is really important for both its people and its businesses. Why? Because it directly impacts how you save, spend, and plan for your future. It's all about financial planning and making sure you follow the country's rules, which we call "compliance."

The Malaysian tax system covers a wide range of things. It includes what individuals pay from their salaries and what companies pay from their profits. It also looks at how Malaysia handles money agreements with other countries, and some new ideas that are popping up in the tax world. To help everyone understand these rules, the Malaysian government has a super helpful online spot called MyTax. This is the official place where you can find all sorts of information about tax-related matters in Malaysia, making it easier for everyone to stay informed and on track. It’s like your personal guide to navigating the tax landscape1.

Diving into Your Own Money: Individual Income Tax in Malaysia

When most people think about tax, they often think about what comes out of their own paycheck. This is called individual income tax, and it's a big part of Malaysia's tax picture. If you're an individual living and working in Malaysia, understanding how this tax works is super important. It’s all about how much of your personal earnings you contribute to the government. This isn't just for Malaysian citizens; if you're an expatriate – someone from another country living and working in Malaysia – these rules apply to you too! Understanding tax implications is also vital if you're investing in property2.

So, how do they figure out how much individual income tax you need to pay? Well, it depends on how much money you earn. Malaysia has a progressive tax system, which means people who earn more usually pay a higher percentage of their income in tax. It’s designed to be fair, so everyone contributes based on their ability. For a really detailed look at how these calculations work and what your duties are3. This guide can give you a clearer picture of what to expect.

For those adventurous souls who have moved to Malaysia from another country, also known as expatriates, navigating the tax system can have its own special twists. You might have questions about what income is taxed, what deductions you can claim, or how your home country's tax rules might interact with Malaysia's. Luckily, there are resources specifically designed to help expats understand their tax requirements4. It’s a great starting point for anyone new to the Malaysian tax scene.

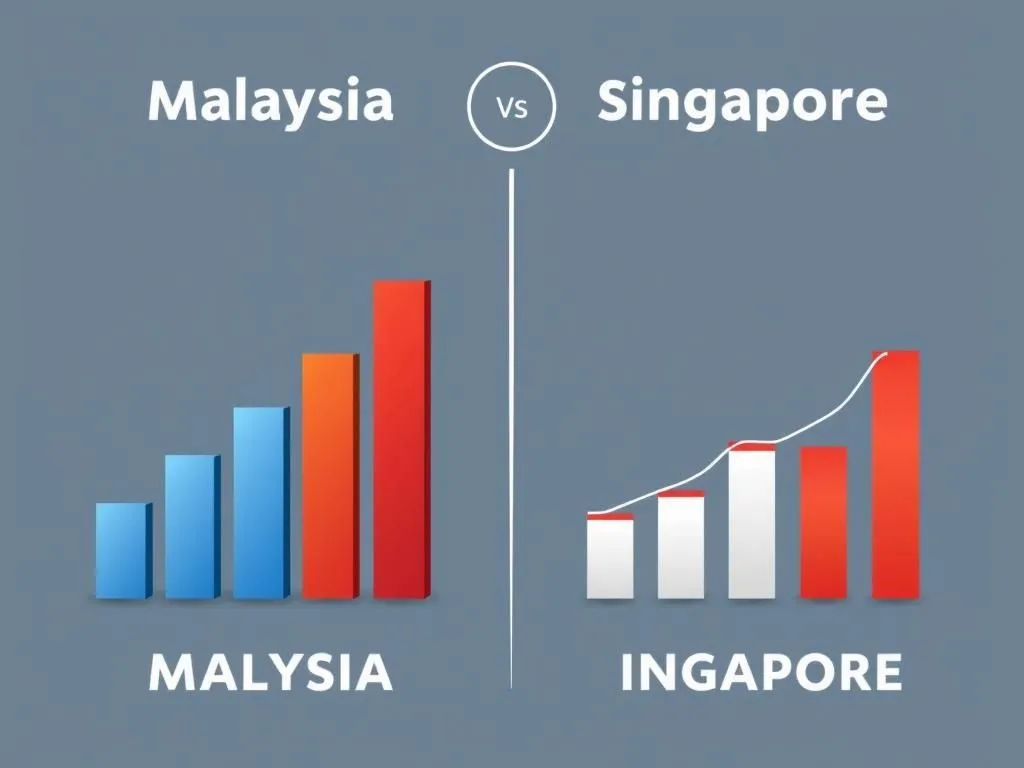

To give you an idea of how Malaysia's individual income tax rates compare, take a look at the image below. It shows how Malaysia stacks up against its neighbour, Singapore. This can be really useful if you're thinking about working in either country and want to understand the tax differences.

Individual income tax rates are an important factor for professionals and expatriates evaluating employment opportunities in different countries. Differences in tax structures between neighboring nations, such as Malaysia and Singapore, significantly influence personal financial planning. This comparative information helps individuals understand their potential tax liabilities in various jurisdictions.

The Global Connection: International Tax Treaties

Imagine you're a business or an individual doing work across different countries. How do you make sure you're not paying tax in both places for the same income? This is where international tax treaties come into play! These are special agreements between two or more countries that help decide which country has the right to tax certain types of income. They're designed to prevent people and companies from being taxed twice on the same money, a problem called "double taxation." These treaties can also influence strategies for international residency5.

For businesses and individuals in Malaysia who have dealings with other countries, knowing about these treaties is super important. They help make international trade and work smoother and fairer. For example, there's been talk about agreements between countries like the United States of America and Malaysia on things like reciprocal trade. While that specific agreement touches on trade, it highlights how nations work together on financial matters6.

If you're dealing with income from the United States, for instance, it's a good idea to know about the income tax treaties that the U.S. has with various countries. The Internal Revenue Service (IRS) is the U.S. government agency responsible for tax collection and tax law enforcement. They provide a comprehensive list of all their income tax treaties from A to Z7. These treaties are like rulebooks that make sure everyone plays fair on the international financial playground!

Beyond Income: Understanding Indirect Taxes

When we talk about tax, it's not just about the income tax you pay from your salary or company profits. There's another big category called indirect taxes. These are taxes that are not directly paid by you to the government, but are instead added to the price of goods and services you buy. Think of it like this: when you purchase something at a store, a little bit extra is often added to the price, and that extra bit is the indirect tax. This type of tax also plays a significant role in helping the government collect money. Understanding indirect taxes is crucial for businesses looking at tax optimization strategies.

In Malaysia, like many other countries, indirect taxes contribute a good chunk to the government's wallet. These taxes can come in different forms, such as sales tax, service tax, or excise duties on certain items. They are "indirect" because the business usually collects them from you when you buy something, and then the business sends that money to the government. So, even if you don't file a specific "indirect tax" return yourself, you're contributing to it every time you make a purchase.

For businesses, especially those that sell goods and services, understanding indirect tax rules is extremely important. They need to know which taxes to collect, how much to collect, and how to send that money to the government properly. It can be a complex area, but resources are available to help. Grant Thornton, a global accounting and advisory firm, offers valuable insights into indirect tax in Malaysia8. It's a key part of the Malaysian tax system that affects almost every transaction!

Tax in the Bigger Picture: How it Affects Malaysia's Economy

When we zoom out and look at tax from a broader perspective, we can see how much it truly impacts the entire country's economy. One important way to measure this impact is by looking at "government tax revenue as a percentage of GDP." Now, that might sound like a mouthful, but let's break it down!

"GDP" stands for Gross Domestic Product, and it's basically the total value of all the goods and services produced in a country in a year. It's like a report card for how well a country's economy is doing. "Government tax revenue" is simply all the money the government collects from taxes. So, when we put them together, "tax revenue as a percentage of GDP" tells us what portion of the country's total economic output comes from taxes. This percentage is a really important number because it shows how much of the country's economic activity is going into the government's funds to pay for public services and investments.

For Malaysia, this data provides a broader economic perspective, showing how much the government relies on taxes to fund its activities. If this percentage is high, it means a significant portion of the country's wealth is being collected through taxes. If it's low, it might suggest the government has less money from taxes to spend on things like infrastructure, education, and healthcare. You can explore this fascinating economic data for Malaysia directly from the World Bank9. This helps us understand how the money collected through taxes flows back into the economy to help Malaysia grow and prosper.

The Digital Age of Tax: Technology in Administration

In today's fast-paced world, almost everything is getting a digital makeover, and tax administration is no exception! Gone are the days when everything had to be done with stacks of paper and long queues. Now, technology is playing a huge role in making tax processes simpler, faster, and more accurate for both governments and taxpayers. This shift towards digital tax administration is a really exciting development, and Malaysia is certainly part of this trend.

Imagine being able to file your taxes online, get instant updates on your tax status, or find answers to your tax questions with just a few clicks. That's the power of technology at work! By using digital tools, governments can manage tax collection more efficiently, reduce errors, and provide better service to the public. For individuals and businesses, it means less hassle and more convenience when dealing with their tax obligations. It makes staying compliant much easier.

Even global tech giants are getting involved in helping countries with their tax systems. For example, Amazon Web Services (AWS), a leading cloud computing platform, offers "Tax Help" resources for Malaysia10. This shows how modern technology infrastructure is being used to support and improve tax administration services. Such platforms can help in managing tax data, processing payments, and even providing support to users. The integration of technology isn't just a fancy add-on; it’s becoming an essential part of how countries like Malaysia manage their tax systems, making them more modern and user-friendly.

Looking Ahead: Emerging Tax Trends in Malaysia

The world of tax is never standing still; it's always evolving with new challenges and ideas. Malaysia is also looking towards the future, considering new types of taxes and how different factors might change how much people and businesses pay. These emerging developments are important because they show where the country is headed in terms of its financial policies and long-term goals.

One of the most talked-about new ideas is the introduction of carbon taxes. What are carbon taxes? They are a fee placed on activities that produce carbon emissions, which are gases that contribute to climate change. The idea is to make polluters pay for their impact on the environment, encouraging everyone to be more eco-friendly. Malaysia has already set a target to introduce a carbon tax by 202611. This move shows Malaysia's commitment to fighting climate change and reaching its goals to reduce carbon emissions. It’s a big step towards a greener future and will likely affect various industries. This will be a major change in the tax landscape!

Another fascinating area that influences tax rates is the connection between public policy, politics, and how much tax companies actually pay. Have you ever wondered if political decisions or a company's connections might impact its tax bill? Research suggests that public policies, which are the plans and actions of the government, and even political connections can play a role in shaping how much tax companies effectively pay. This is an important topic because it touches on fairness and transparency in the tax system. Understanding these dynamics helps us see the broader influences on corporate taxation12. These future changes and underlying influences mean that the Malaysian tax system is dynamic and always evolving! Discussions on tax avoidance versus tax evasion are also relevant here, as strategies and compliance are key.

Conclusion: Staying Ahead in Malaysia's Tax Journey

Wow, what an adventure we've had exploring the exciting and important world of tax in Malaysia! We've seen how this fundamental system underpins the country's growth, touching everything from your personal paycheck to the operations of huge international companies. We started by understanding the crucial role of taxation for individuals and businesses, learning that platforms like MyTax are your official go-to for tax information.

We then delved into the specifics of individual income tax, realizing that understanding your personal contributions is key for financial planning, with detailed insights available from PwC and special guides for expatriates from HSBC. We also looked at how Malaysia connects with the global economy through international tax treaties, which help prevent double taxation for those with international dealings, referencing agreements like those the U.S. might have with Malaysia and resources from the IRS.

Beyond direct income taxes, we discovered the impact of indirect taxes, which contribute significantly to government revenue, with resources from Grant Thornton explaining their role. Zooming out, we saw how tax revenue impacts Malaysia's overall economy by looking at the percentage of GDP, a metric tracked by the World Bank. We also highlighted the exciting integration of technology in tax administration, making processes more efficient and user-friendly, as evidenced by services like AWS Tax Help.

Finally, we peered into the future, uncovering emerging developments like Malaysia's commitment to a carbon tax by 2026 and the intriguing influence of public policy and political connections on effective tax rates. Understanding global strategies for tax is also helpful in this context.

It's clear that Malaysia's tax system is a complex yet fascinating landscape, constantly adapting to new economic realities and global trends. For residents, businesses, and expatriates alike, staying informed about these developments isn't just a recommendation—it's a necessity for sound financial planning and compliance. The journey through Malaysia's tax system is ongoing, and by understanding its foundations and future directions, we can all navigate it with greater confidence and clarity. Keep learning, keep asking questions, and stay informed to master your personal and business tax journey in Malaysia!

Frequently Asked Questions

Question: What is the primary purpose of taxes in Malaysia?

Answer: Taxes in Malaysia serve as the main source of government revenue, which is then allocated to fund essential public services such as infrastructure development, education, healthcare, and national security.

Question: How does Malaysia's individual income tax system work?

Answer: Malaysia operates a progressive individual income tax system, meaning individuals with higher incomes pay a larger percentage of their earnings in tax. This system is designed to ensure fairness and equity in contributions to national development.

Question: What are international tax treaties and why are they important for Malaysia?

Answer: International tax treaties are agreements between Malaysia and other countries that aim to prevent individuals and businesses from being taxed twice on the same income (double taxation). They are crucial for facilitating international trade and investment by providing clarity and stability in cross-border financial transactions.

Disclaimer: The information is provided for general information only. BridgeProperties makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.