Your Passport to Paradise: Unveiling the Secrets of Property Buying Malaysia

Key Takeaways

- Strategic Investment: Malaysia offers a vibrant property market for foreign buyers seeking second homes, investment opportunities, or relocation.

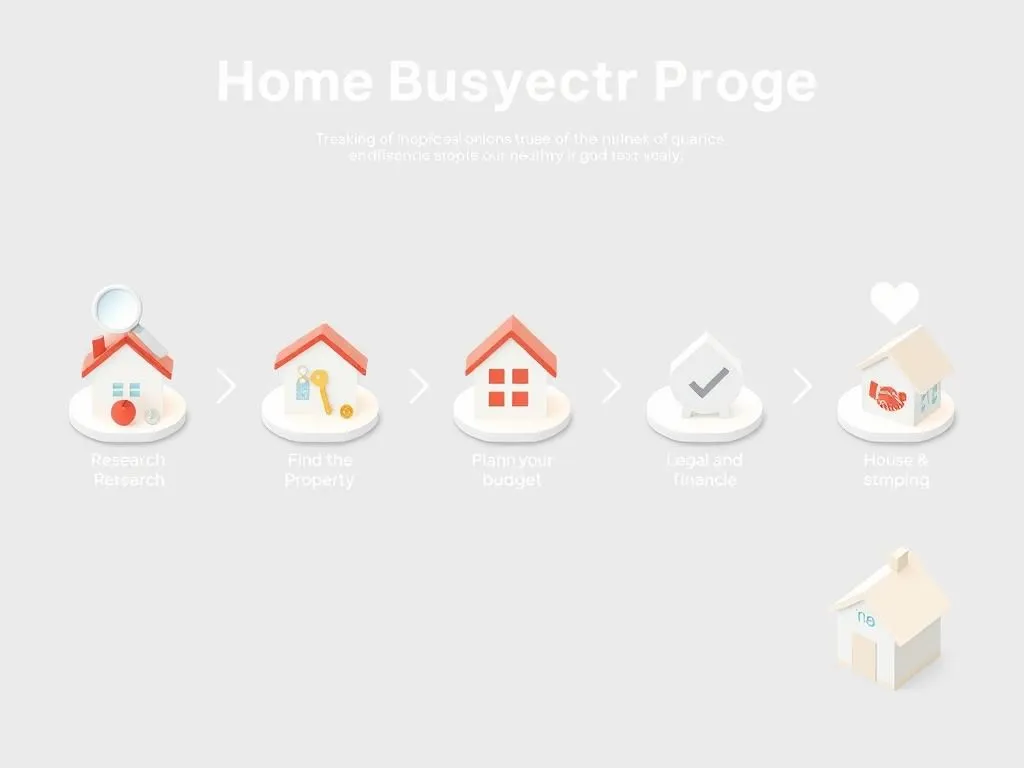

- Clear Roadmap: The process of buying property as a foreigner involves distinct stages from research and planning to legal and financial due diligence.

- Regulatory Nuances: Understanding minimum purchase prices, property type restrictions, and programs like MM2H is crucial for a smooth acquisition.

- Financial Preparedness: Foreigners should plan for cash purchases, explore Malaysian or international financing, and account for all associated costs.

- Income Generation: The market offers potential for rental income and capital appreciation, particularly in key urban and developing areas.

Property Buying Malaysia – for many, it conjures images of vibrant cities, pristine beaches, and a tantalizing blend of cultures. It's a dream of a sun-drenched second home, a smart investment, or perhaps a new beginning in a dynamic Southeast Asian nation. But for foreigners looking to dip their toes into this exciting market, the journey can seem complex. Fear not, intrepid adventurer! This comprehensive guide is your compass, navigating the thrilling landscape of Malaysian real estate with clarity and confidence.

This document provides a preliminary guide for foreigners interested in purchasing property in Malaysia. The process, while potentially rewarding, requires careful consideration of various factors. From understanding the local laws to securing your finances, every step is a crucial piece of the puzzle. We’re here to help you unlock the potential of this incredible market and avoid common missteps, making your dream of owning a piece of Malaysia a reality. Get ready to explore!

The Magnetic Pull: Why Foreigners Are Flocking to Property Buying Malaysia

Malaysia has become a beacon for international property buyers, and it’s not hard to see why. This diverse nation offers a unique blend of modern infrastructure and rich cultural heritage, alongside a relatively affordable cost of living compared to many Western countries. From bustling Kuala Lumpur with its iconic Petronas Towers to the serene islands of Langkawi and the historical charm of Penang, there's a property for every taste and ambition.

The economy is robust, the people are welcoming, and the legal framework for foreign ownership is generally clear, albeit with specific rules. Whether you're eyeing a luxury condominium in a metropolitan hub, a tranquil villa by the sea, or a commercial space for a new venture, Malaysia's property market offers a compelling proposition. It’s an exciting time to consider investing here, with opportunities constantly emerging for those willing to do your homework.

Navigating the Maze: Essential Pitfalls and Smart Considerations

Before you get carried away by the allure of a Malaysian address, it’s vital to approach the journey with a clear head. Understanding the potential "pitfalls" is crucial before committing to a purchase. Just like any significant investment, buying property in a foreign country comes with its unique set of challenges and considerations. Engaging with the experiences of others can provide valuable initial awareness. For instance, discussions on platforms like Reddit highlight common concerns, offering insights into potential hurdles faced by buyers1.

What kind of pitfalls are we talking about? They can range from minimum property purchase prices for foreigners, which vary by state, to restrictions on certain types of land or properties. Legal complexities, understanding local taxes, and even cultural nuances in negotiation can all present challenges. It's not about being discouraged, but about being prepared. Careful consideration of these factors from the outset can save you time, money, and stress down the line. It truly pays to be informed and to seek expert advice. You can unpack more challenges associated with buying property in Malaysia here2.

Your Roadmap to Ownership: A Step-by-Step Guide to Property Buying Malaysia

So, you’ve weighed the pros and cons, and your heart is set on a Malaysian property. Fantastic! Now, let’s break down the fundamental steps of buying property in Malaysia. Think of this as your personal roadmap, guiding you through each stage of the process with confidence. Resources like Wise and Emerhub provide fundamental overviews that are incredibly helpful for foreigners3, 4.

The journey typically involves several key stages, each requiring attention to detail.

The process of acquiring a home involves a sequence of structured stages, from initial exploration to finalizing legalities. A crucial aspect of successful property transactions is meticulous financial planning, including the establishment of a comprehensive budget. Navigating these defined steps ensures a smoother experience for prospective homeowners.

Step 1: Research and Planning – Setting Your Sights

Before you even look at listings, it’s essential to do your homework. This involves:

- Defining Your Purpose: Are you buying for investment, retirement, a holiday home, or relocation? Your purpose will influence the type of property and location you consider.

- Budgeting: Clearly define your budget, remembering to factor in not just the purchase price, but also stamp duties, legal fees, agent commissions, and potential renovation costs. The image above reminds us of the importance of planning your budget right from the start.

- Location, Location, Location: Malaysia is diverse. Research different states and cities. Do you prefer the hustle and bustle of Kuala Lumpur, the coastal charm of Penang, or the natural beauty of Sabah? Each area has different regulations and property values.

- Property Types: Potential buyers should research options, including residential and commercial properties. Are you looking for a landed house, a condominium, an apartment, or perhaps a shop lot? Each has different legal implications for foreign ownership.

- Market Trends: Keep in mind that the local market can fluctuate considerably. Understanding current market trends and future projections for your chosen area is vital.

Step 2: Finding Your Dream Property – The Hunt Begins

With your research complete and your budget set, it’s time for the exciting part: finding your property!

- Online Portals: The digital age makes property hunting much easier. Websites like realtor.com and iProperty are examples of portals to locate properties, offering a vast array of listings. However, for active recommendations and a comprehensive platform to explore properties for sale, Property Guru is an excellent resource for finding Houses for Sale. You can check out current listings and explore possibilities on their site5, 6, 7.

- Engaging a Real Estate Agent: A local, reputable real estate agent can be an invaluable asset. They have in-depth knowledge of the market, can help you find suitable properties that meet foreign ownership requirements, and assist with negotiations.

- Viewings: Once you have a shortlist, arrange viewings. This is your chance to assess the property's condition, location, and suitability in person. Ask lots of questions!

Step 3: Legal and Financial Due Diligence – Checking Every Box

This is arguably the most critical stage, ensuring everything is above board.

- Engage a Lawyer: You will absolutely need a Malaysian lawyer specializing in property law. They will conduct due diligence, verify the property's title, check for encumbrances, and advise you on the legal process.

- Letter of Offer: Once you find a property you like, you'll typically sign a Letter of Offer and pay an earnest deposit (usually 2-3% of the purchase price). This secures the property for a short period, allowing time for the Sale and Purchase Agreement (SPA) to be drafted.

- Sale and Purchase Agreement (SPA): This is the main legal document outlining the terms and conditions of the sale. Your lawyer will review this meticulously to protect your interests. It specifies the purchase price, payment schedule, responsibilities of both buyer and seller, and the completion period.

- Financing: If you require a home loan, this is the stage to finalize your financing with a bank. We'll delve deeper into financial considerations shortly.

Step 4: Stamping and Registration – Making It Official

With the SPA signed and financing secured, the final legal steps are taken.

- Stamp Duty: You will need to pay stamp duty on the SPA. This is a government tax on property transactions and can be a significant cost. Your lawyer will guide you on the exact amount.

- Transfer of Title: The lawyer will then proceed with the transfer of title (Memorandum of Transfer) at the Land Office. This officially registers you as the new owner of the property.

- Utility Connections: Once the property is legally yours, you'll need to arrange for utility connections (electricity, water, internet) if they are not already set up or transferred.

Financial Foundations: What You Need to Know for Your Malaysian Purchase

Money matters, especially when making a large investment like property. Understanding the financial landscape is crucial for a smooth transaction. Foreigners often face specific considerations, from banking to securing loans.

One fundamental step for foreigners is opening a personal bank account in Malaysia. This is essential for managing your property-related finances, from making payments to receiving rental income if you decide to let out your property. Discussions in online expat groups frequently touch upon this topic, providing useful advice on the process8. Typically, you'll need your passport, a valid visa (if applicable), and sometimes a letter of introduction or proof of address. It’s always best to check with individual banks for their specific requirements as they can vary.

When it comes to financing your property purchase, foreign buyers typically have a few options:

- Cash Purchase: If you have the capital, buying outright in cash simplifies the process significantly as you avoid the complexities of securing a foreign loan.

- Malaysian Bank Loans: While possible, securing a home loan from a Malaysian bank as a foreigner can be more challenging than for local citizens. Banks will assess your creditworthiness, income stability, and residency status. Loan-to-value (LTV) ratios for foreigners might also be lower, meaning you’ll need a larger down payment.

- International Financing: Some foreign banks with operations in Malaysia, or even banks in your home country, might offer financing options. Explore these thoroughly to compare interest rates and terms.

Remember to factor in all associated costs beyond the purchase price, including legal fees, stamp duties, agent commissions, and ongoing maintenance fees or property taxes. A clear financial plan is your best friend throughout this exciting journey. Navigating financial complexities is essential, as highlighted in our guide to buying property9.

Unleashing Potential: Investment Opportunities and Generating Income

For many foreigners, buying property in Malaysia isn't just about finding a home; it's about making a smart investment. The Malaysian property market offers exciting opportunities for those looking to generate income or see their assets grow.

One of the most common ways to generate income is by renting out your property. The question, "Can you buy a property in Malaysia and rent it out the next day?" is a popular topic in expat forums, indicating a strong interest in this strategy10. In general, yes, once you own the property and it's legally yours, you can rent it out. However, understanding the local rental market, rental yields, and landlord-tenant laws is crucial. Factors like location, property type, and amenities will significantly influence your rental income potential. Popular areas for rental investment include major cities like Kuala Lumpur, Penang, and Johor Bahru, especially properties near universities, business districts, or tourist attractions.

Beyond direct rental income, the broader Malaysian property market presents various investment strategies. A comprehensive guide, "Investing in Malaysia Property: The Ultimate Guide," offers detailed information on this topic. This guide offers insights into different property types, investment strategies, and the overall market outlook11. It delves into:

- Residential Properties: Condominiums, apartments, and landed houses can offer both rental income and capital appreciation, especially in growing urban areas.

- Commercial Properties: Shop lots, office spaces, or industrial units can yield higher rental returns but often come with higher entry costs and different market dynamics.

- Emerging Areas: Identifying up-and-coming townships or regions slated for significant infrastructure development can lead to substantial capital appreciation over time.

- Long-Term vs. Short-Term Investment: Some investors focus on long-term growth, while others might look for opportunities for shorter-term gains through renovation and resale.

Understanding the cyclical nature of the property market and external economic factors is also vital. While the market can fluctuate, Malaysia's long-term growth trajectory and strategic location often make it an attractive prospect for patient investors. Always conduct thorough market research and consider consulting with local property investment advisors to tailor a strategy that aligns with your financial goals.

Navigating Regulations: The MM2H Program and Other Key Requirements

Understanding the regulatory landscape is paramount when engaging in property buying Malaysia. Foreign ownership is permitted, but it comes with specific rules and programs designed to attract international residents and investors. One of the most significant initiatives for foreigners looking to reside in Malaysia long-term and potentially purchase property is the Malaysia My Second Home (MM2H) program.

The MM2H program is a long-term social visit pass that allows eligible foreigners to live in Malaysia on a multiple-entry visa. While it is not a direct path to citizenship or permanent residency, it offers significant benefits, including the ability to purchase property. It's important to understand the latest requirements, such as the new MM2H program in West Malaysia. Discussions on social media platforms provide insights into these evolving requirements12.

The MM2H program has seen several updates and revisions over the years, impacting eligibility criteria, financial requirements (such as fixed deposit amounts and offshore income), and minimum stay durations. Generally, applicants must meet certain age, income, and financial asset thresholds. For instance, recent changes have often included higher fixed deposit requirements and stricter liquid asset criteria. It is absolutely crucial to consult the official Malaysian government immigration website or a reputable MM2H agent for the most current and accurate information, as program details can change.

Beyond the MM2H program, other general requirements for foreign property ownership typically include:

- Minimum Purchase Price: Most states in Malaysia impose a minimum property purchase price for foreign buyers. This threshold can vary significantly from state to state (e.g., Kuala Lumpur, Selangor, Penang, Johor). Properties below this minimum are typically reserved for Malaysian citizens. This is a critical factor to research based on your desired location.

- Property Type Restrictions: Foreigners are generally restricted from owning certain types of properties, such as Malay Reserve Land, agricultural land (in most cases), and low-cost residential units. Strata titles (condominiums and apartments) and commercial properties are often more accessible.

- State Authority Approval: In many instances, foreign purchases require approval from the respective state authority. This approval process can add time to the overall transaction. Your lawyer will manage this on your behalf.

- Legal Fees and Taxes: As mentioned earlier, stamp duty, legal fees, and other government taxes are standard requirements for property transactions. Understanding these costs upfront is essential for budgeting.

- Currency Exchange: Foreigners will be dealing with currency exchange. It's advisable to use reputable services and understand exchange rates and transfer fees, as these can impact the overall cost of your purchase.

Staying informed about these requirements and working closely with experienced local professionals – lawyers, real estate agents, and MM2H consultants – will ensure a smooth and compliant property acquisition process. The rules are in place to protect both buyers and the local market, and adhering to them is key to a successful investment. You can navigate this regulatory landscape confidently by understanding the challenges.

Conclusion: Your Malaysian Property Dream Awaits!

The journey of Property Buying Malaysia as a foreigner is an adventure filled with promise and potential. We’ve explored the magnetic allure of this vibrant nation, delved into the essential considerations and potential pitfalls, and meticulously charted the step-by-step process from initial research to sealing the deal. We've uncovered the financial foundations you'll need, the exciting investment opportunities available, and the crucial regulatory landscape, including the evolving MM2H program.

Remember, while the prospect of owning a piece of Malaysian paradise is incredibly exciting, success lies in preparation and informed decision-making. Embrace the reporter-style curiosity we’ve encouraged throughout this guide – ask questions, conduct thorough research, and always engage with trusted local experts. From securing your finances and navigating legal requirements to identifying the perfect property and understanding the dynamic market, every step is a discovery. This guide aims to help you navigate the market challenges.

Whether you envision a serene retirement haven, a bustling income-generating asset, or a new chapter in a culturally rich land, Malaysia offers a compelling canvas for your dreams. Armed with this knowledge and a spirit of adventure, your exciting journey into Malaysian property ownership is ready to begin. The future is bright, and your new address in Malaysia awaits! You can address first time buyer hurdles through informed decisions.

Frequently Asked Questions

Question: What is the minimum property purchase price for foreigners in Malaysia?

Answer: The minimum property purchase price for foreigners varies significantly by state in Malaysia. Each state sets its own threshold, and properties below this minimum are typically reserved for Malaysian citizens.

Question: Can foreigners get a home loan from a Malaysian bank?

Answer: Yes, it is possible for foreigners to obtain a home loan from a Malaysian bank, but it can be more challenging than for local citizens. Banks will assess creditworthiness, income stability, and residency status, and loan-to-value ratios for foreigners might be lower.

Question: Are there restrictions on the type of property foreigners can own in Malaysia?

Answer: Yes, foreigners are generally restricted from owning certain types of properties such as Malay Reserve Land, agricultural land (in most cases), and low-cost residential units. Strata titles (condominiums and apartments) and commercial properties are often more accessible for foreign ownership.

Disclaimer: The information is provided for general information only. BridgeProperties makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.